Fuck 'em. Putin needs to be fucking dead.

26 Re: Time to Choose … 2/25/2022, 2:55 pm

Re: Time to Choose … 2/25/2022, 2:55 pm

zsomething

Yeah, "peacekeepers" my ass.

Fuck 'em. Putin needs to be fucking dead.

Fuck 'em. Putin needs to be fucking dead.

Floridatexan, Sal and Telstar like this post

28 Re: Time to Choose … 2/26/2022, 9:01 am

Re: Time to Choose … 2/26/2022, 9:01 am

Sal

Last night at a Republican event in Orlando, “Putin! Putin! Putin!!”

The floor is yours, Pkr.

Floridatexan and Telstar like this post

29 Re: Time to Choose … 2/26/2022, 1:13 pm

Re: Time to Choose … 2/26/2022, 1:13 pm

Guest

Guest

"A Republican event"... lol. Gawd you're easy... but that's the useful idiot nature.

30 Re: Time to Choose … 2/26/2022, 1:35 pm

Re: Time to Choose … 2/26/2022, 1:35 pm

Sal

PkrBum wrote:"A Republican event"... lol. Gawd you're easy... but that's the useful idiot nature.

Ain’t no Democrats in the audience, shitheel.

Floridatexan, Telstar and RealLindaL like this post

32 Re: Time to Choose … 2/27/2022, 8:37 am

Re: Time to Choose … 2/27/2022, 8:37 am

Guest

Guest

You do love your propaganda... I'll give you that.

33 Re: Time to Choose … 2/27/2022, 9:40 am

Re: Time to Choose … 2/27/2022, 9:40 am

Guest

Guest

Senate votes down Cruz's bill to impose sanctions over Nord Stream pipeline

By Ted Barrett and Matthew Hoye, CNN

Updated 11:14 PM ET, Thu January 13, 2022

https://www.cnn.com/2022/01/13/politics/nord-stream-pipeline-democrats-defeat-cruz-bill/index.html

(CNN)The Senate on Thursday voted down legislation from GOP Sen. Ted Cruz of Texas to sanction entities associated with Russia's controversial Nord Stream 2 pipeline.

Needing 60 votes to pass, it failed 55-44. A handful of Democrats running for reelection voted with Republicans, including Sens. Catherine Cortez Masto of Nevada, Maggie Hassan of New Hampshire, Mark Kelly of Arizona and Raphael Warnock of Georgia. Democratic Sens. Tammy Baldwin of Wisconsin and Jacky Rosen of Nevada also crossed the aisle.

Sen. Rand Paul of Kentucky was the lone Republican to oppose the bill.

The Biden administration had argued that the sanctions would undercut US efforts to deter the threat from Russia. A number of Democrats had been weighing whether to break from the White House and back the Cruz measure, wary about appearing soft on Russia amid rising tensions with Ukraine and eager to send a strong message to Russian President Vladimir Putin, including over the pipeline that runs from Russia to Germany.

The vote came after Democrats reached a compromise last month with Cruz, who agreed to lift his holds on multiple Biden administration State Department nominees if he got a vote on his sanctions measure.

Ahead of the vote, Senate Foreign Relations Chair Bob Menendez took to the floor to urge members to vote no, and lobbied for his own bill that would impose sanctions only if Putin decides to invade Ukraine.

By Ted Barrett and Matthew Hoye, CNN

Updated 11:14 PM ET, Thu January 13, 2022

https://www.cnn.com/2022/01/13/politics/nord-stream-pipeline-democrats-defeat-cruz-bill/index.html

(CNN)The Senate on Thursday voted down legislation from GOP Sen. Ted Cruz of Texas to sanction entities associated with Russia's controversial Nord Stream 2 pipeline.

Needing 60 votes to pass, it failed 55-44. A handful of Democrats running for reelection voted with Republicans, including Sens. Catherine Cortez Masto of Nevada, Maggie Hassan of New Hampshire, Mark Kelly of Arizona and Raphael Warnock of Georgia. Democratic Sens. Tammy Baldwin of Wisconsin and Jacky Rosen of Nevada also crossed the aisle.

Sen. Rand Paul of Kentucky was the lone Republican to oppose the bill.

The Biden administration had argued that the sanctions would undercut US efforts to deter the threat from Russia. A number of Democrats had been weighing whether to break from the White House and back the Cruz measure, wary about appearing soft on Russia amid rising tensions with Ukraine and eager to send a strong message to Russian President Vladimir Putin, including over the pipeline that runs from Russia to Germany.

The vote came after Democrats reached a compromise last month with Cruz, who agreed to lift his holds on multiple Biden administration State Department nominees if he got a vote on his sanctions measure.

Ahead of the vote, Senate Foreign Relations Chair Bob Menendez took to the floor to urge members to vote no, and lobbied for his own bill that would impose sanctions only if Putin decides to invade Ukraine.

34 Re: Time to Choose … 2/27/2022, 11:30 am

Re: Time to Choose … 2/27/2022, 11:30 am

Floridatexan

The Lincoln Project is a group of REPUBLICANS, dumbass.

And Germany has cancelled the Nord Stream 2 pipeline project, while President Biden has imposed sanctions on Putin personally, and his oligarch supporters.

And Germany has cancelled the Nord Stream 2 pipeline project, while President Biden has imposed sanctions on Putin personally, and his oligarch supporters.

Sal, Telstar, RealLindaL and zsomething like this post

35 Re: Time to Choose … 2/27/2022, 11:51 am

Re: Time to Choose … 2/27/2022, 11:51 am

Sal

PkrBum wrote:

Updated 11:14 PM ET, Thu January 13, 2022

Thank goodness the world is static.

Rube.

Floridatexan, Telstar and zsomething like this post

36 Re: Time to Choose … 2/27/2022, 12:01 pm

Re: Time to Choose … 2/27/2022, 12:01 pm

Guest

Guest

Sal wrote:PkrBum wrote:

Updated 11:14 PM ET, Thu January 13, 2022

Thank goodness the world is static.

Rube.

It was sure as hell static foriegn policy by Biden and dems for the near year Putin amassed forces on the Ukraine border. Were you just wishing for the best too? Actively supporting Putin by giving him material support like the pipeline? Fool... you wouldn't know the geopolitical reality if it slapped you across the face. Which Putin did.

37 Re: Time to Choose … 2/27/2022, 12:15 pm

Re: Time to Choose … 2/27/2022, 12:15 pm

Sal

PkrBum wrote:

It was sure as hell static foriegn policy by Biden and dems for the near year Putin amassed forces on the Ukraine border. Were you just wishing for the best too?

Yet, somehow Biden has unified the globe in opposition even after Trump spent his entire tenure weakening alliances. Even China and Turkey won’t stand with Putin. He’s in a box of Biden’s making.

PkrBum wrote: Fool... you wouldn't know the geopolitical reality if it slapped you across the face. Which Putin did.

Still an admirer, eh?

That’s nice.

Floridatexan, Telstar, RealLindaL and zsomething like this post

38 Re: Time to Choose … 2/28/2022, 11:56 am

Re: Time to Choose … 2/28/2022, 11:56 am

Floridatexan

Moscow Stock Exchange Can’t Open as Russian Stock Prices Collapse on Foreign Exchanges

By Pam Martens and Russ Martens: February 28, 2022 ~

Putin started an unprovoked war in Ukraine and now finds himself losing a serious financial battle at home. Anything connected to Putin is now toxic: that includes his country’s currency, its stock exchange, its banks, its major corporations, and its central bank. Even Russia’s vodka is being removed from shelves in Canada and the U.S.

The central bank of Russia (Bank of Russia) first announced earlier today that the Moscow Stock Exchange would open at 10 a.m. Moscow time (2 a.m. New York time) but there would be no stock trading, just trading in the foreign exchange, currency and repo markets. A further decision on opening up the stock exchange for stock trading was set for 1 p.m. Moscow time (5 a.m. New York time). Stock trading has still not opened on the Moscow Stock Exchange and even the website of the Moscow Stock Exchange was not functioning as of 7 a.m. ET Monday morning.

Unfortunately for Putin, investors are able to see where Russia’s major corporations are trading because many of them also trade on foreign exchanges: as of 8:16 a.m. ET on Monday, this is where some major Russian corporations were trading on the London Stock Exchange: Sberbank (down 69 percent); Rosneft (down 39 percent); Novatek (down 67 percent). That follows plunges in their stock prices at the end of last week after Russia invaded Ukraine.

Norway’s sovereign wealth fund, the largest in the world, said it would no longer buy Russian companies and will begin divesting from its $3 billion in Russian stocks. British Petroleum (BP) announced its plan to exit its 19.75 percent stake in Russian oil company, Rosneft. It said both of its BP-nominated Directors would immediately resign from the Rosneft Board.

Apparently anticipating a wave of selling by other sovereign wealth funds, the Russian central bank said it was temporarily banning Russian brokers from selling securities held by foreigners.

The Russian currency, the Ruble, is also in major trouble. After collapsing to an historic low against the U.S. Dollar last week, the Ruble fell by as much as another 30 percent in early Monday trading. In an effort to stem the plunge, the Russian central bank hiked its benchmark interest rate by more than double, from 9.5 percent to 20 percent.

The Russian central bank has, itself, lost its credibility to prop up its currency over the long haul or to intervene effectively in other markets. That’s because its $640 billion in foreign currency and gold reserves is effectively frozen throughout much of the world. According to a Joint Statement from the European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States on Saturday, they have agreed to “imposing restrictive measures that will prevent the Russian Central Bank from deploying its international reserves in ways that undermine the impact of our sanctions.” According to Ursula von der Leyen, the President of the European Commission, that means that the EC plans to “ban the transactions of Russia’s central bank and freeze all its assets, to prevent it from financing Putin’s war.”

This morning, the U.S. Treasury Department also indicated that it was freezing the assets of the Russian central bank that are held in the U.S.

As the Russian Ruble dramatically loses value against foreign currencies, and the Russian central bank is crippled from propping it up, imports become more costly for Russian consumers. That will further foment anger against Putin. As many as 5,000 anti-war protesters have already been arrested in Russia, according to human rights monitors.

The same joint statement from the European Commission, the U.S. and other allies said that “selected” Russian banks were being removed from the SWIFT system. That system is the primary method that banks and corporations quickly and efficiently pay for goods and transfer funds across Europe. The names of exactly which banks are being removed from SWIFT has yet to be released. As we reported on Friday, global banks in the U.S., France, Austria and Italy have major bank operations in Russia. It will be interesting to see if the Russian units of those banks are removed from SWIFT.

Russia is also facing bank runs. Over the weekend, long lines were forming in Russia to take cash from banks’ ATMs. According to Reuters, there was a run today on the European arm of Russia’s largest bank, Sberbank. Reuters reported that “Sberbank Europe and two other subsidiaries were set to fail, after ‘significant deposit outflows’ linked to ‘geopolitical tensions,’ according to the ECB.”

Putin, whose mental status is now being questioned around the globe, hiked tensions further over the weekend by announcing in a televised statement that he was putting his nuclear-armed forces on high alert.

Russian and Ukraine officials were set to meet this morning to engage in discussions.

https://wallstreetonparade.com/2022/02/moscow-stock-exchange-cant-open-as-russian-stock-prices-collapse-on-foreign-exchanges/

**************

Telstar and zsomething like this post

39 Re: Time to Choose … 3/1/2022, 10:03 am

Re: Time to Choose … 3/1/2022, 10:03 am

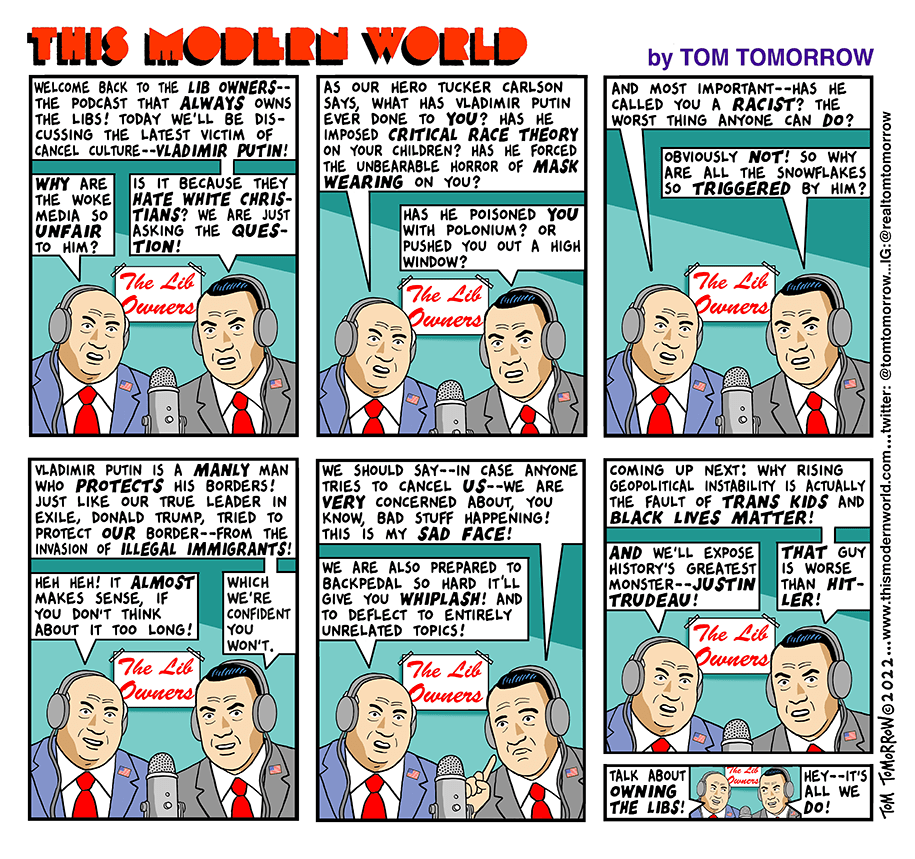

zsomething

Floridatexan, Telstar and RealLindaL like this post

40 Re: Time to Choose … 3/1/2022, 6:29 pm

Re: Time to Choose … 3/1/2022, 6:29 pm

Guest

Guest

Jfc... this is the vp... the backup to a senile old man. I hope nothing even more serious happens for the next few years. We are so fucked if it does.

“Ukraine is a country in Europe. It exists next to another country called Russia. Russia is a bigger country. Russia decided to invade a smaller country called Ukraine, so basically that’s wrong"

“Ukraine is a country in Europe. It exists next to another country called Russia. Russia is a bigger country. Russia decided to invade a smaller country called Ukraine, so basically that’s wrong"

42 Re: Time to Choose … 3/2/2022, 1:15 pm

Re: Time to Choose … 3/2/2022, 1:15 pm

Sal

PkrBum wrote:Jfc... this is the vp... the backup to a senile old man. I hope nothing even more serious happens for the next few years. We are so fucked if it does.

“Ukraine is a country in Europe. It exists next to another country called Russia. Russia is a bigger country. Russia decided to invade a smaller country called Ukraine, so basically that’s wrong"

So, the plan is to memory hole everything Trump said in his four years in office and everything he said prior and since?

Good plan, rube.

Floridatexan and Telstar like this post

43 Re: Time to Choose … 3/2/2022, 1:18 pm

Re: Time to Choose … 3/2/2022, 1:18 pm

Sal

“But in almost every case, the sanctions were imposed with Trump complaining about it saying we were being too hard. The fact is that he barely knew where Ukraine was. He once asked John Kelly, his second chief of staff, if Finland were a part of Russia. It is just not accurate to say that Trump’s behavior somehow deterred the Russians. I think the evidence is that Russia didn’t feel that their military was ready.” - John-fucking-Bolton

https://www.vanityfair.com/news/2022/03/john-bolton-donald-trump-ukraine-finland-russia/amp

https://www.vanityfair.com/news/2022/03/john-bolton-donald-trump-ukraine-finland-russia/amp

Floridatexan, Telstar and zsomething like this post

44 Re: Time to Choose … 3/3/2022, 5:58 am

Re: Time to Choose … 3/3/2022, 5:58 am

Guest

Guest

Nord Stream 2: Trump approves sanctions on Russia gas pipeline

https://www.bbc.com/news/world-europe-50875935

Dec 21, 2019

President Donald Trump has signed a law that will impose sanctions on any firm that helps Russia's state-owned gas company, Gazprom, finish a pipeline into the European Union.

The sanctions target firms building Nord Stream 2, an undersea pipeline that will allow Russia to increase gas exports to Germany.

The US considers the project a security risk to Europe.

Both Russia and the EU have strongly condemned the US sanctions.

Congress voted through the measures as part of a defence bill last week and the legislation, which described the pipeline as a "tool of coercion", was signed off by Mr Trump on Friday.

https://www.bbc.com/news/world-europe-50875935

Dec 21, 2019

President Donald Trump has signed a law that will impose sanctions on any firm that helps Russia's state-owned gas company, Gazprom, finish a pipeline into the European Union.

The sanctions target firms building Nord Stream 2, an undersea pipeline that will allow Russia to increase gas exports to Germany.

The US considers the project a security risk to Europe.

Both Russia and the EU have strongly condemned the US sanctions.

Congress voted through the measures as part of a defence bill last week and the legislation, which described the pipeline as a "tool of coercion", was signed off by Mr Trump on Friday.

45 Re: Time to Choose … 3/3/2022, 11:16 am

Re: Time to Choose … 3/3/2022, 11:16 am

Telstar

I give you one ball, you give me two.

Floridatexan and zsomething like this post

47 Re: Time to Choose … 3/7/2022, 5:21 pm

Re: Time to Choose … 3/7/2022, 5:21 pm

Guest

Guest

Oops... we know she knows... but she's not supposed to admit it. Please ignore comrades.

Jen Psaki: Biden "was the vice president the last time Russia invaded Ukraine, this is a pattern"

Jen Psaki: Biden "was the vice president the last time Russia invaded Ukraine, this is a pattern"

50 Re: Time to Choose … 3/9/2022, 3:16 pm

Re: Time to Choose … 3/9/2022, 3:16 pm

Sal

PkrBum wrote:Oops... we know she knows... but she's not supposed to admit it. Please ignore comrades.

Jen Psaki: Biden "was the vice president the last time Russia invaded Ukraine, this is a pattern"

At what point will confessing to being a useful idiot be less embarrassing than holding tight and looking like a willing co-conspirator?

Genuinely curious about this.

Floridatexan, Telstar and zsomething like this post

Go to page :  1, 2, 3

1, 2, 3

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum

Home

Home