The rich are getting richer so that's all good, right?

"Today, President Obama will be in Denver, talking about improvements in the economic picture and his work toward making them happen. The unemployment rate is at 6.1 percent, and the United States has added 1.4 million new jobs since the beginning of 2014.

Despite Obama's intentions of spreading the good news, though, Colorado's top Democratic officials are staying away from the speech. And few Democratic candidates in close elections around the country are citing economic gains as a reason to elect them. Instead, the party continues to advance its agenda as the best way to fix a still-struggling economy.

Why the disconnect? Well, despite the sunnier jobs picture and some indications of the economy's upswing, most Americans haven't felt much of a change yet.

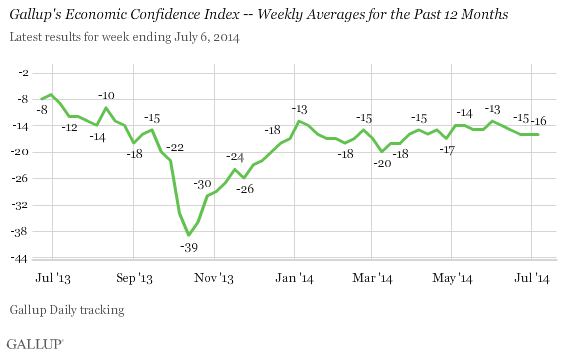

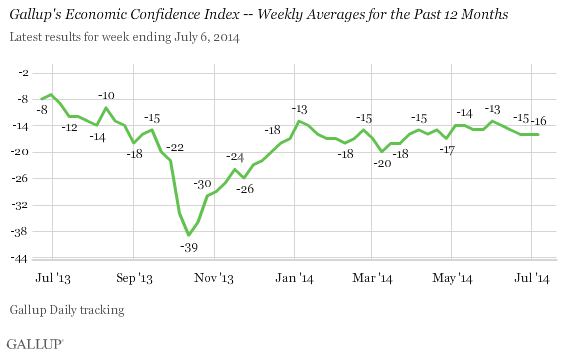

Gallup's economic confidence index -- which measures whether Americans think the economy is improving or getting worse, along with their current perception of the economy -- remains double-digits negative, right about where it was at the start of 2014. Only one in five Americans think the economy is excellent or good. The Fannie Mae National Housing Survey, released this week, found that 54 percent of Americans think the economy is on the wrong track.

More than 40 percent of the jobs created in the past year have been in food service, retail and temporary help, according to the Wall Street Journal. These sectors of the economy typically have the lowest wages. In other words, the decreasing unemployment number doesn't do a great job of capturing the quality of the new employment.

"Today, President Obama will be in Denver, talking about improvements in the economic picture and his work toward making them happen. The unemployment rate is at 6.1 percent, and the United States has added 1.4 million new jobs since the beginning of 2014.

Despite Obama's intentions of spreading the good news, though, Colorado's top Democratic officials are staying away from the speech. And few Democratic candidates in close elections around the country are citing economic gains as a reason to elect them. Instead, the party continues to advance its agenda as the best way to fix a still-struggling economy.

Why the disconnect? Well, despite the sunnier jobs picture and some indications of the economy's upswing, most Americans haven't felt much of a change yet.

Gallup's economic confidence index -- which measures whether Americans think the economy is improving or getting worse, along with their current perception of the economy -- remains double-digits negative, right about where it was at the start of 2014. Only one in five Americans think the economy is excellent or good. The Fannie Mae National Housing Survey, released this week, found that 54 percent of Americans think the economy is on the wrong track.

More than 40 percent of the jobs created in the past year have been in food service, retail and temporary help, according to the Wall Street Journal. These sectors of the economy typically have the lowest wages. In other words, the decreasing unemployment number doesn't do a great job of capturing the quality of the new employment.

Home

Home