that's progress

Last edited by :) on 5/3/2014, 9:51 am; edited 1 time in total (Reason for editing : fixed for the spelling nazi's)

its good to know the left has finally accepted that they are the cause for the recession 5/2/2014, 9:00 pm

its good to know the left has finally accepted that they are the cause for the recession 5/2/2014, 9:00 pm

Last edited by :) on 5/3/2014, 9:51 am; edited 1 time in total (Reason for editing : fixed for the spelling nazi's)

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:01 am

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:01 am Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 7:50 am

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 7:50 am Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 9:50 am

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 9:50 am Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 10:46 am

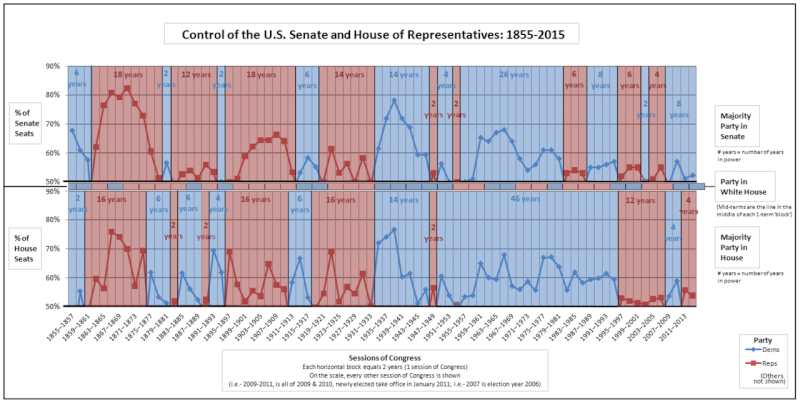

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 10:46 am:)Every time the left here cries that the republicans in congress is to blame for the economy, which they have in threads all over this forum, I just want to remind them who was in control of both houses when the recession hit.

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:11 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:11 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:14 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:14 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:18 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:18 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:25 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:25 pm2seaoat wrote:What recession?

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:33 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 12:33 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 1:28 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 1:28 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 2:17 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 2:17 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 4:28 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 4:28 pm:)some people might want to look at who has had majority control in our life time.

wow look at all the years dems have controlled both houses during our lifetime. I bet a lot of liberal policy making was done in those years that we are still feeling.

dems won congressional elections in 2006 and were installed jan 2007 till 2009

According the U.S. National Bureau of Economic Research (the official arbiter of U.S. recessions) the US recession began in December 2007 and ended in June 2009, and thus spanned over 18 months

http://en.wikipedia.org/wiki/Great_Recession

The subsequent bust in 2008 caused the most devastating economic downturn since the Depression.

http://www.businessweek.com/articles/2014-05-01/clinton-officials-missed-chance-to-avert-2008-financial-crisis

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 4:55 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 4:55 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 5:01 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 5:01 pm Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 5:40 pm

Re: its good to know the left has finally accepted that they are the cause for the recession 5/3/2014, 5:40 pm2seaoat wrote:Again, I ask the question......what recession?

Pensacola Discussion Forum » Politics » its good to know the left has finally accepted that they are the cause for the recession

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum

|

|

|