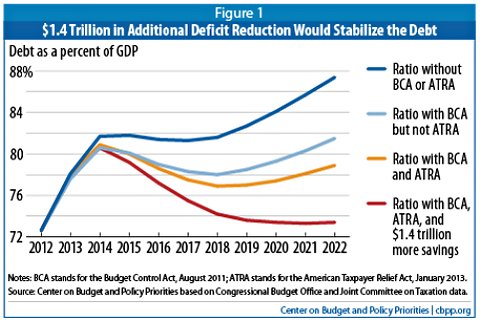

Check out the graphics.

Morons ...

Morons ...

Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 1:42 pm

Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 1:42 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:36 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:36 pmSal wrote:Someone Needs to Explain to FAUX News How Money Works

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:41 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:41 pmBob wrote:Sal wrote:Someone Needs to Explain to FAUX News How Money Works

No doubt. But someone also needs to explain to FAUX ME why this trillion dollar coin idea is not the goofiest thing I've heard of since MacGyver went off the air. In fact, I don't even think the Professor on Gilligan's Island had an idea as goofy as this is.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:52 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 3:52 pmYes I absolutely do believe the trillion dollar coin is about as MacGyver'esque as it gets.boards of FL wrote:Bob wrote:Sal wrote:Someone Needs to Explain to FAUX News How Money Works

No doubt. But someone also needs to explain to FAUX ME why this trillion dollar coin idea is not the goofiest thing I've heard of since MacGyver went off the air. In fact, I don't even think the Professor on Gilligan's Island had an idea as goofy as this is.

Well, now that you mention it, if MacGyver were currently president and found himself in the current debt ceiling situation, don't you think he would fashion a trillion dollar coin in the 11th hour and save the day? If that isn't MacGyver, what is?

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 4:05 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 4:05 pmBob wrote:Sal wrote:Someone Needs to Explain to FAUX News How Money Works

No doubt. But someone also needs to explain to FAUX ME why this trillion dollar coin idea is not the goofiest thing I've heard of since MacGyver went off the air. In fact, I don't even think the Professor on Gilligan's Island had an idea as goofy as this is.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 4:37 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 4:37 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 5:07 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 5:07 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 5:45 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 5:45 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:19 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:19 pmBob wrote:Pkr,

Our government is now like a family with decreasing family income while the family is maxed out on credit cards and other debts. All it can do is try to get more credit cards to temporarily stave off the inevitable insolvency.

Like the family who's breadwinner is hoping to get a better job to provide more income as a solution, our government thinks it's going to grow more and better jobs too and those jobs will provide the income to cope with the growing debt.

The federal budget is in no way analogous to a household budget.

The only "solution" I see is inevitable insolvency and then we try to rebuild from the ashes.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:28 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:28 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:33 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:33 pmBob wrote:

Well I guess you've nailed me. All I care about is keeping rich people from paying taxes, raiding social security, and making poor and middle class people pay for more military. I cannot deny it longer.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:34 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:34 pmSal wrote:

The deficit is not a problem.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:40 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:40 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:42 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:42 pmIt wasn't "deficit hawks in DC" who taught me arithmetic, Sal.Sal wrote:

No, Bob.

I was referring to the deficit hawks in DC.

You know, the ones who duped you into believing the federal budget is analogous to a household budget.

LOL

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:48 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:48 pmBob wrote:

It wasn't "deficit hawks in DC" who taught me arithmetic, Sal.

I learned arithmetic from being a sole proprieter for 40 years. Believe me, that is the best education you can get about money and finance there is.

And one principle I learned is that you can only get away with spending more than you take in for so long before that strategy eventually bites you in the ass. It's not a lot different than treading water in the ocean. Sooner or later you gonna drown.

And even as phenomenally brilliant as they are, not even the obamas and paloosis and reids are brilliant enough to defy the laws of arithmetic and get away with it forever.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:50 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:50 pmPkrBum wrote:The lowest earners in this country live a life of privilege compared to the vast majority in the world... but pay no income taxes.

The top half of earners in this country pay nearly all of the income taxes... this "fair share" crap has a target audience.

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:58 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 6:58 pm Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 7:19 pm

Re: Someone Needs to Explain to FAUX News How Money Works 1/11/2013, 7:19 pmPkrBum wrote:The lowest earners in this country live a life of privilege compared to the vast majority in the world... but pay no income taxes.

The top half of earners in this country pay nearly all of the income taxes... this "fair share" crap has a target audience.

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 8:42 am

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 8:42 amSal wrote:Bob wrote:

It wasn't "deficit hawks in DC" who taught me arithmetic, Sal.

I learned arithmetic from being a sole proprieter for 40 years. Believe me, that is the best education you can get about money and finance there is.

And one principle I learned is that you can only get away with spending more than you take in for so long before that strategy eventually bites you in the ass. It's not a lot different than treading water in the ocean. Sooner or later you gonna drown.

And even as phenomenally brilliant as they are, not even the obamas and paloosis and reids are brilliant enough to defy the laws of arithmetic and get away with it forever.

Start here, Bob ...

1. The US federal government is 221 years old, if we date its birth to the adoption of the Constitution. Arguably, that is about as good a date as we can find, since the Constitution established a common market in the US, forbade states from interfering with interstate trade (for example, through taxation), gave to the federal government the power to levy and collect taxes, and reserved for the federal government the power to create money, to regulate its value, and to fix standards of weight and measurement-from whence our money of account, the dollar, comes. I don’t know any head of household with such an apparently indefinitely long lifespan. This might appear irrelevant, but it is not. When you die, your debts and assets need to be assumed and resolved. There is no “day of reckoning”, no final piper-paying date for the sovereign government. Nor do I know any household with the power to levy taxes, to give a name to — and issue — the currency we use, and to demand that those taxes are paid in the currency it issues.

2. With one brief exception, the federal government has been in debt every year since 1776. In January 1835, for the first and only time in U.S. history, the public debt was retired, and a budget surplus was maintained for the next two years in order to accumulate what Treasury Secretary Levi Woodbury called “a fund to meet future deficits.” In 1837 the economy collapsed into a deep depression that drove the budget into deficit, and the federal government has been in debt ever since. Since 1776 there have been exactly seven periods of substantial budget surpluses and significant reduction of the debt. From 1817 to 1821 the national debt fell by 29 percent; from 1823 to 1836 it was eliminated (Jackson’s efforts); from 1852 to 1857 it fell by 59 percent, from 1867 to 1873 by 27 percent, from 1880 to 1893 by more than 50 percent, and from 1920 to 1930 by about a third. Of course, the last time we ran a budget surplus was during the Clinton years. I do not know any household that has been able to run budget deficits for approximately 190 out of the past 230-odd years, and to accumulate debt virtually nonstop since 1837.

3. The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929. (Do you see any pattern? Take a look at the dates listed above.) With the exception of the Clinton surpluses, every significant reduction of the outstanding debt has been followed by a depression, and every depression has been preceded by significant debt reduction. The Clinton surplus was followed by the Bush recession, a speculative euphoria, and then the collapse in which we now find ourselves. The jury is still out on whether we might manage to work this up to yet another great depression. While we cannot rule out coincidences, seven surpluses followed by six and a half depressions (with some possibility for making it the perfect seven) should raise some eyebrows. And, by the way, our less serious downturns have almost always been preceded by reductions of federal budget deficits. I don’t know of any case of a national depression caused by a household budget surplus.

4. The federal government is the issuer of our currency. Its IOUs are always accepted in payment. Government actually spends by crediting bank deposits (and credits the reserves of those banks); if you don’t want a bank deposit, government will give you cash; if you don’t want cash it will give you a treasury bond. People will work, sell, panhandle, lie, cheat, steal, and even kill to obtain the government’s dollars. I wish my IOUs were so desirable. I don’t know any household that is able to spend by crediting bank deposits and reserves, or by issuing currency. OK, some counterfeiters try, but they go to jail.

5. Some claim that if the government continues to run deficits, some day the dollar’s value will fall due to inflation; or its value will depreciate relative to foreign currencies. But only a moron would refuse to accept dollars today on the belief that at some unknown date in the hypothetical and distant future their value might be less than today’s value. If you have dollars you don’t want, please send them to me. Note that even if we accept that budget deficits can lead to currency devaluation, that is another obvious distinguishing characteristic: my household’s spending in excess of income won’t reduce the purchasing power of the dollar by any measurable amount.

http://rooseveltinstitute.org/new-roosevelt/federal-budget-not-household-budget-here-s-why

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 9:56 am

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 9:56 amBob wrote:"From 1817 to 1821 the national debt fell by 29 percent; from 1823 to

1836 it was eliminated (Jackson’s efforts); from 1852 to 1857 it fell by

59 percent, from 1867 to 1873 by 27 percent, from 1880 to 1893 by more

than 50 percent, and from 1920 to 1930 by about a third."

That's why it's different from all that now, Sal. No one, not any progressive politician in Washington, not any progressive pundit in Washington, and not Obama, is even suggesting that anything can be done to reduce the $16 trillion debt we have now. The best case scenario any of them have is only to stabilize and possibly reduce the amount which is being added to the debt each year. And none of those proposals even claim to accomplish that before about ten years out.We're no longer living in the 1800's or the 1900's, Sal. None of that applies anymore. Just as what was the case in southern Europe in the long ago past doesn't mitigate what's happening to it now either.All that crap you quoted is now just useless political rhetoric.

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 10:07 am

Re: Someone Needs to Explain to FAUX News How Money Works 1/12/2013, 10:07 amYou nailed it. I only worry about democrat debt. I love republican debt and that's because Bush was a Christian and Obama is a muslim. I just believe in my heart of hearts that a Christian like Bush would never do us wrong since he's doing the work of Jesus.Floridatexan wrote:

Where in God's name was all this deficit discussion when Bush was in office? Practically nonexistent. The only reason the debt ceiling and the deficit are "serious" matters now is that there's not a Republican in the White House.

Pensacola Discussion Forum » General Discussion » Someone Needs to Explain to FAUX News How Money Works

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum

|

|

|