http://www.bls.gov/news.release/empsit.nr0.htm

Great news for Americans. Terrible news for republicans.

Great news for Americans. Terrible news for republicans.

BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 10:46 am

BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 10:46 am Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 10:50 am

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 10:50 am Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 12:58 pm

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 12:58 pm

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 5:06 pm

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/8/2016, 5:06 pmRobust Hiring in December Caps Solid Year for U.S. Jobs

In an impressive sprint at 2015’s end, employers added 292,000 workers to their payrolls in December, the government said on Friday, punctuating a year of healthy growth.

The unemployment rate stayed at 5 percent last month, the Labor Department said, but that was mostly because large numbers of people went looking for work.

The department revised its earlier estimate of job creation in October and November, adding 50,000 more jobs to last year’s totals. All in all, the economy added 2.65 million jobs for the year, capping a two-year gain that was the best since the late 1990s.

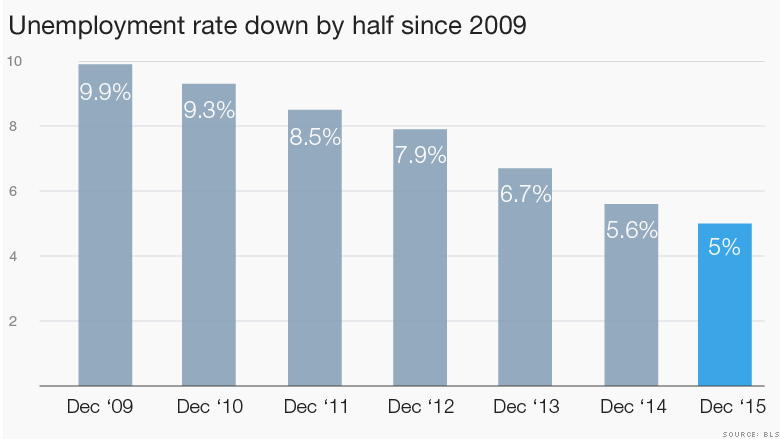

The jobless rate, which has declined since topping the 10 percent mark in October 2009, continues to hover just above what economists consider full employment — the point where further declines could start to push up inflation.

Despite the improving job market, sluggish wage growth remains a persistent thorn. Wages remained flat in December.

Looking ahead, the biggest question is whether overall growth will remain strong enough to keep hiring steady, or whether turmoil in China and elsewhere in the global economy will weigh on the United States economy by holding down exports and further undercutting the struggling manufacturers.

“We certainly see the impact of global conditions in the manufacturing sector, where the strong dollar and weak commodities prices have diminished momentum substantially,” Mr. Tannenbaum said, “but the service side of the American economy is progressing unabated.”

Mark Zandi, chief economist at Moody’s Analytics, acknowledged that “there are a lot of crosscurrents.” Although the auto industry reported record vehicle sales in 2015, he noted, “anything trade-sensitive is getting hammered because of what’s going on overseas.”

Still, he was enthusiastic about job creation.

“The remarkable thing is how consistent employment growth has been over the past three or four years,” Mr. Zandi said. “We’re getting at least 200,000 jobs per month on a consistent basis. That’s quite an achievement.”

The average monthly gain in jobs last year, 221,000, was better than the 2013 average of 199,000, but short of the 260,000 reached in 2014. (Since the figures posted Friday are preliminary, the 2015 average could change.)

The country’s economic fortunes will figure largely in this year’s presidential campaign. Republican candidates have attacked President Obama and other Democrats’ economic policies, though such criticisms could lose their sting if the employment picture continues to improve.

Cautious optimism about the labor market contributed to the Federal Reserve’s decision a few weeks ago to raise interest rates from their near-zero levels, where they had rested since 2008. Analysts are now scanning the employment and wage figures for signs of how quickly the Fed will follow up with further rate increases.

The report announced each month by the Labor Department is by nature a single snapshot and because of the holidays, December is always a bit anomalous.

Andrew Chamberlain, chief economist at Glassdoor Economic Research, noted that in job postings, there was a dip in December. “That’s something that happens every year as people take vacation,” he said, adding that he expected a reversal in the coming month. “Looking forward, January is the best time to be looking for a job. There’s always a big jump in labor demand in January.”

Mr. Chamberlain said worker benefits like paid parental leave and free catered lunches had significantly outpaced wage increases over the past decade. But those gains have occurred primarily at the nation’s larger companies (those with more than 500 employees) and among the highest skilled workers or members of unions, which have some bargaining power.

“That’s definitely part of what we’re seeing here with slow wage growth,” Mr. Chamberlain said.

The pain of a disappointing paycheck has been blunted by the continued decline in oil prices, which has lowered the cost of heating a home or filling up a car.

Economists say that in addition to fundamental shifts in the economy, continuing slack in the labor market is partly responsible for the lack of improvement on wages. Many Americans have been forced to settle for part-time work or are too discouraged to keep job hunting after years of fruitless searching.

An analysis of long-term changes affecting the labor market released this week by the Federal Reserve Bank of St. Louis focused on how automation and offshoring were continuing to reduce the number of middle-skill jobs, like those in manufacturing and production. One result is a labor market that increasingly resembles a barbell, with jobs concentrated at the high- and low-skill ends of the spectrum.

“The picture is clear: Employment in nonroutine occupations — both cognitive and manual — has been increasing steadily for several decades,” the report concluded. “Employment in routine occupations, however, has been mostly stagnant.”

That trend has contributed to record low labor participation rates, which barely ticked up to 62.6 percent last month.

Unforeseen at the end of last year were the balmy temperatures in the Northeast and elsewhere. That clearly hurt retailers like Macy’s, which announced this week it was laying off 4,500 employees, largely because of a sharp decline in sales of coats and other winter wear, even as warmer weather enabled construction workers to remain on the job longer. Employers in that sector added 45,000 jobs in December.

Professional and business services registered the largest gains last month, with 73,000 new jobs.

The job hunting outlook varies significantly depending on the region of the country.

Tom Gimbel, chief executive of LaSalle Network, a Chicago staffing firm, said business has been brisk through the holiday season. “They’re hiring,” Mr. Gimbel said of his clients, which include companies in the for-profit education, financial technology and consumer lending sectors. “I’ve had more open orders and more business on the board than I’ve ever had.”

At the headquarters of Sitel, a customer care provider in Nashville, Tenn., the company has been celebrating the biggest growth in years. Sean Erickson, executive vice president, said that in 2015, Sitel hired 7,500 people in the United States for sales, customer service, technical support and front-line management positions.

“Where we saw the greatest growth was in financial services, retail, travel and transportation,” Mr. Erickson said, with weaker demand in manufacturing and communications. He said the company, with 62,000 employees worldwide, had poured money into employee training.

The company’s success also highlights how much the job market has shifted. One of the biggest areas of growth has come from providing flexible, temporary or part-time employees who can work from home to help businesses quickly scale staffing up, or down, according to demand, Mr. Erickson said.

Capturing the high spirits that greeted the early morning report, the economist Justin Wolfers tweeted: “Where are we at? Low unemployment. Rapid job gains. No inflationary pressures — and so the boom goes on.”

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/9/2016, 11:08 am

Re: BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%. 1/9/2016, 11:08 amboards of FL wrote:The jobless rate, which has declined since topping the 10 percent mark in October 2009, continues to hover just above what economists consider full employment — the point where further declines could start to push up inflation.

Pensacola Discussion Forum » Politics » BLS Employment Situation: 292,000 jobs added to the economy in December. Unemployment rate holds at 5.0%.

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum

|

|

|